BIMCO’s Chief Shipping Analyst, Niels Rasmussen, gives his insight into the market in June 2022.

Recent Developments

A combination of high demand and congestion, and the consequences of these has remained the order of the market during the past six months. Thus, high freight rates, charter rates, and asset prices as well as supply chain disruptions and liner operators reporting record results are appearing commonplace.

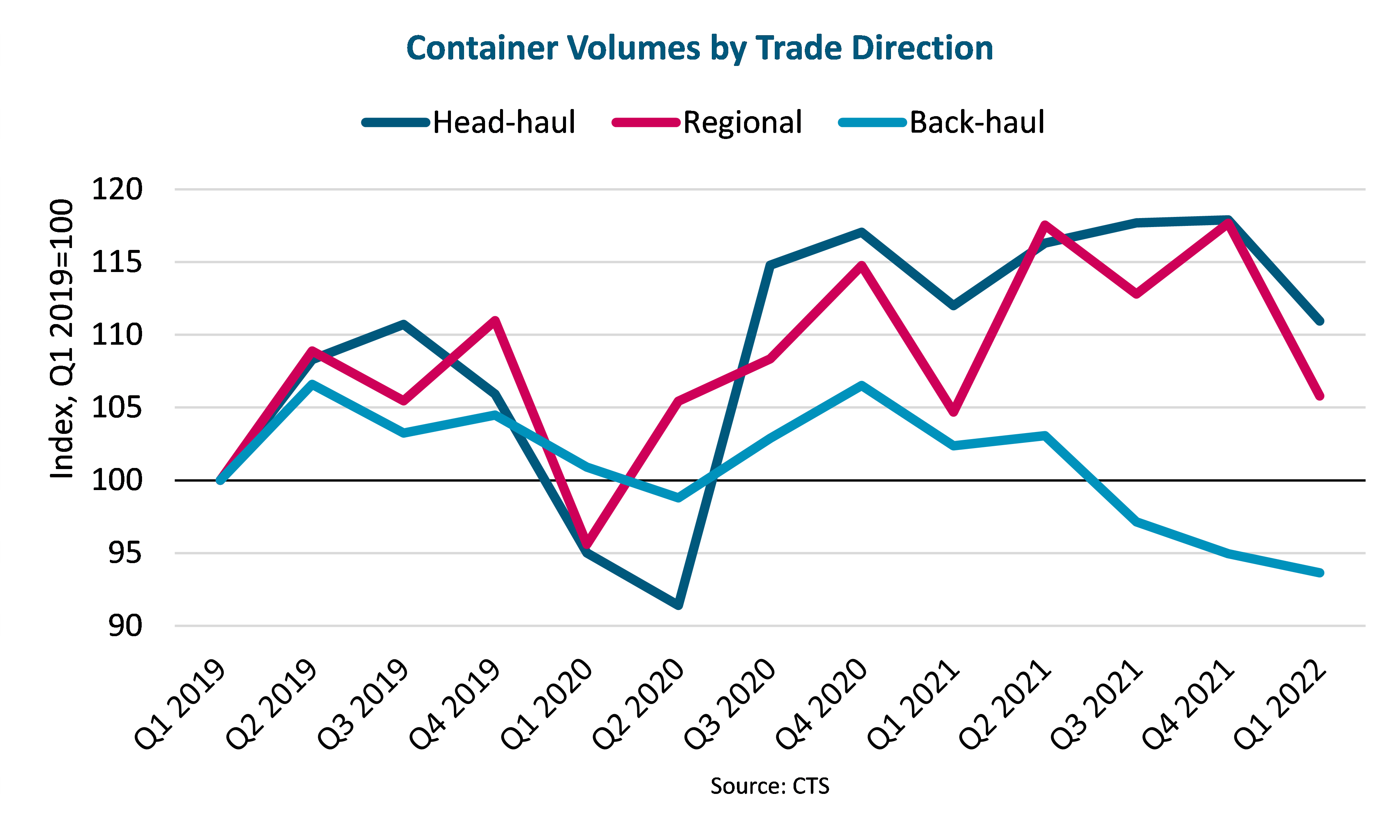

Nevertheless, container volumes have shown some early signs of weakening. Reported head-haul and regional container volumes, which are the drivers of rates and prices, profitability, and congestion, were down 0.4% y/y and 1.4% y/y respectively in March 2022 but remained 11.0% and 1.8% up on March 2019. Volumes into Oceania and Europe were particularly weak in March and were down 8.6% y/y and 6.9% y/y respectively, whereas volumes into North America continued to power ahead and showed 5.8% y/y growth.

Though still high compared to the pre-COVID market, there has been a noticeable impact on rates and prices as well as activity in the asset markets.

- The China Containerized Freight Index (CCFI) has slipped 12.6% from its peak in early-November 2021.

- In the time charter market, rates have slowed a little since peaking in late March and owners have had to accept much shorter time charter periods, which on average are now down to two years from a peak of four years in mid-2021.

- Second-hand prices appear to have peaked for now and the number of transactions has slowed significantly.

- Newbuilding contracting and price increases have slowed.

Congestion has been particularly high around ports in the US, although the problem has recently been shifting away from West Coast ports to East Coast ports. Shippers appear to be increasingly favouring East Coast ports in order to bypass West Coast congestion and inland capacity constraints, as well as to guard against any disruption that may arise from the renegotiation of the ILWU longshoremen’s contract, which will expire at the end of June.

In China, the extended COVID lockdown in Shanghai has led to increased congestion as liner operators have attempted to divert some ships to other ports. Overall, the lockdown has led to an increase in cancelled sailings as liner operators attempt to match capacity to demand. In the short-term this has helped reduce congestion on the US West Coast, and it also could point towards a stronger than normal peak season as shippers attempt to ship cargo that was delayed during the lockdown; and thereby a return to higher congestion levels.

The war in Ukraine is now entering its fourth month and has, of course, been on everybody’s mind. Services to Ukraine have been suspended and most major shipping lines have also suspended their services in Russia. At present, the loss of these two markets is not a great concern from a global demand perspective, though it may hurt specific trade lanes. In the meantime, the war has triggered rises in energy and food prices, while inflation has been increasing globally. When combined with the expected increases in interest rates, the true cost of the war to the container market is likely to be a reduction in consumers’ discretionary spending.

Demand Drivers

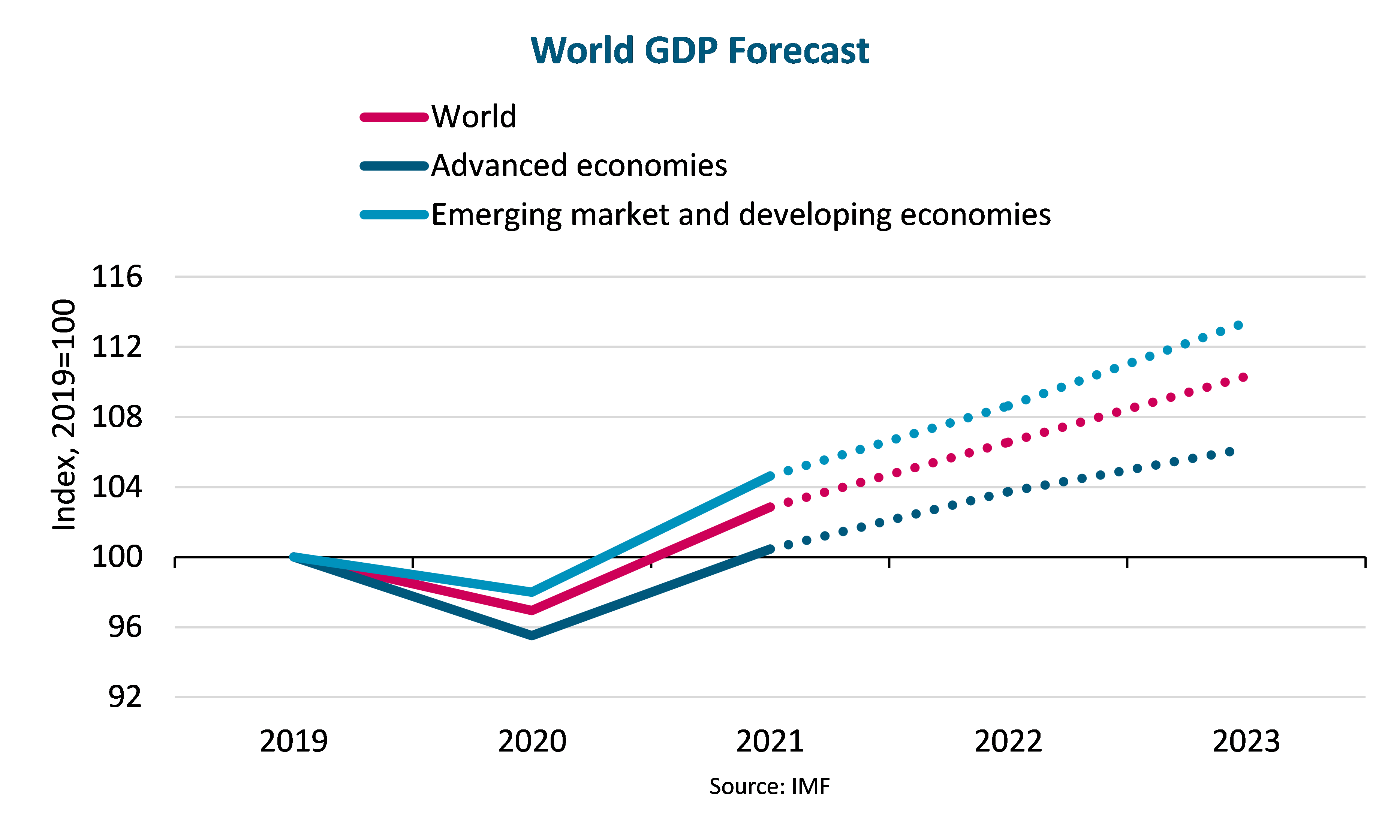

In April, the International Monetary Fund (IMF) lowered their forecast for global GDP growth to 3.6% for 2022 and 3.6% for 2023. These figures are down 0.8 pp and 0.2 pp respectively on those forecast in January, prior to Russia’s invasion of Ukraine. The forecast for the Europe & Mediterranean area has been reduced to 1.8% and 2.1% for respectively 2022 and 2023, whereas growth in North America is expected to be 3.6% in 2022 and 2.3% 2023.

IMF’s forecast mentions large downside risks related to further adverse developments in commodity prices, supply chain disruptions, inflation, and financial conditions. In their worst-case scenario, the IMF predicts that GDP in 2023 could end up 2.0% lower than the baseline forecast. A recent report from the OECD highlights the risk. In Q1 2022, the combined GDP of the G7 countries is estimated to have shrunk by 0.1% q/q, whereas the IMF’s baseline forecast assumes that the combined GDP of the G7 economies will grow by 3.2% in 2022.

Led by high levels of consumption in the US and a shift away from services towards goods, we estimate that global head-haul and regional container volumes in 2021 were 5 million TEU (3.6%) higher than GDP developments can explain. In order to predict container demand in 2022 and 2023, it is therefore just as important to estimate whether these consumption patterns will begin to normalise as it is to estimate the overall impact of GDP growth on demand.

Many indicators point to consumer spending and retail sales volumes having plateaued in the US, and downside risks exist:

- US inflation has risen to its highest levels since the 1980s and is weighing on discretionary income.

- Interest rates have just been increased by the Federal Reserve Board and further increases are expected over the coming months.

- Manufacturing PMIs around the world have started to drop, having fallen below 50 in China.

- In expectation of lower corporate earnings, the S&P Global 1200 stock index has fallen 10% since the beginning of 2022.

- Consumer confidence is at its lowest level since 2011.

- Spending on services has recovered and has returned to pre-COVID levels.

- Real disposable income in the US has normalised (1.8% higher than pre-COVID levels) and personal savings have dropped 3.0 pp below pre-COVID levels.

- An increasing number of consumers are reported to be dipping into their savings to pay for necessities, and more than a third are again finding it difficult to cover normal household expenses.

- Over the last twelve months, monthly CPI and seasonally adjusted retail and food sales have been within ±3% of the average.

Retail inventories relative to sales meantime remain 18.9% lower than in January 2020. Even if retail sales begin to slip it could take a while before it impacts container volumes as retailers likely need to rebuild inventories. In absolute terms inventories are, however, higher the before COVID and some are finding it hard to find additional warehouse space.

In the Europe & Mediterranean region, consumers in the EU have reported the second-lowest confidence level on record. As in the US, retail sales have remained remarkably steady from April 2021 to March 2022. It does, however, seem reasonable to expect that the low consumer confidence level will eventually hurt retail sales, especially if/when interest rates also increase.

Elsewhere, consumers in countries dependent on energy and food imports are facing a similar pressure on discretionary income. In many countries, the pressure will be even higher than in North America and Europe & Mediterranean as food and energy expenses often add up to a much higher share of disposable income. There is a genuine risk of a severe food crisis in many low-income countries.

All in all, conditions for consumers appear to be worsening across most of the world and businesses will naturally be impacted as well. Considering this and the predictions made by the IMF, we believe that demand growth in head-haul and regional trades will be muted during 2022 and 2023 and will be considerably lower than the average annual growth of 3.4% that was observed between 2013 and 2019. As highlighted by the IMF, there are many risks to the global economy and, consequently, to container demand.

Supply

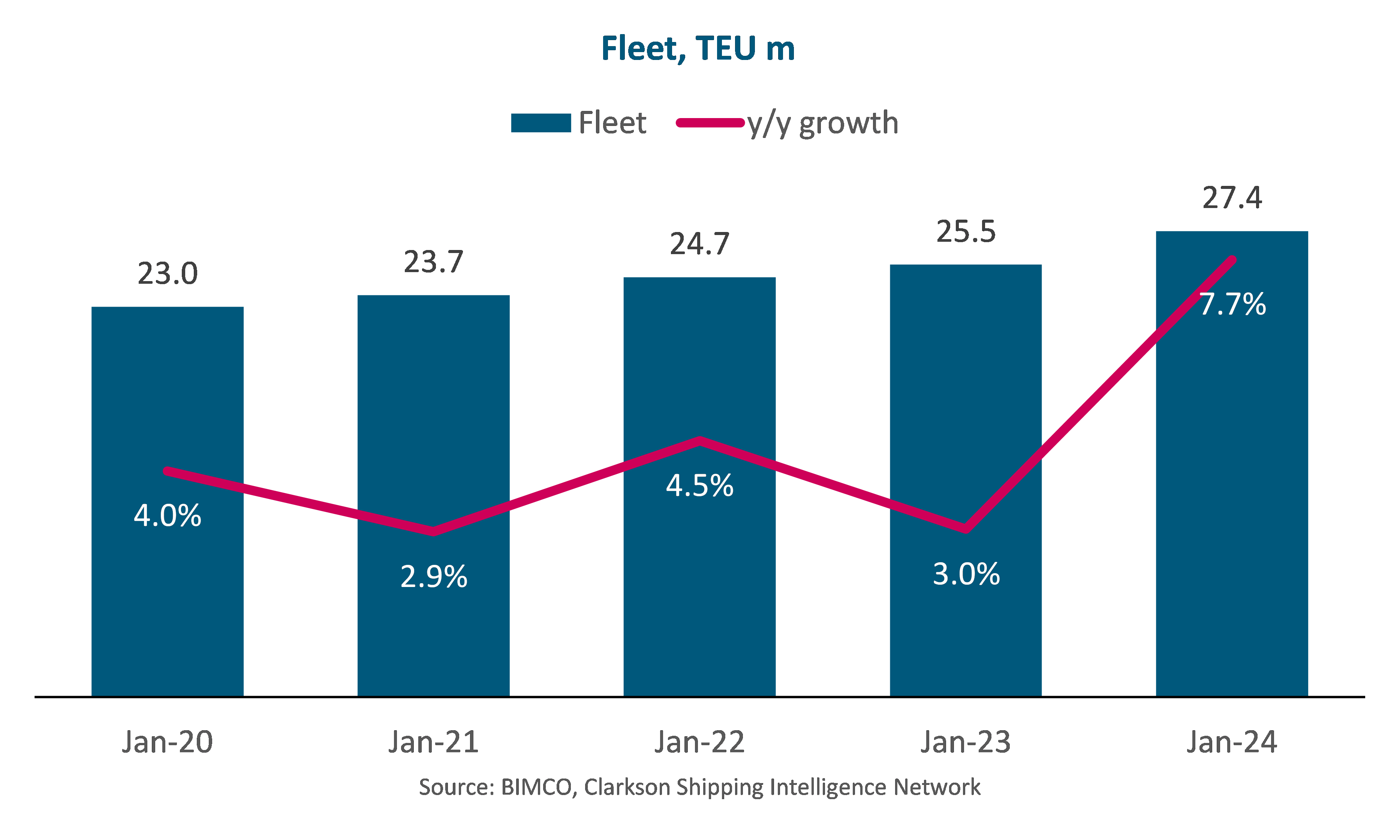

Contracting activity has been high since Q4 2020 and 6.3 million TEU in new contracts have been signed since then. Deliveries of these ships will begin in 2023 but many will be delivered in 2024 and 2025.

Due to the very strong market, demolition activity has come to a virtual halt during the same period and at present there is no indication of an immediate increase.

We currently estimate that the fleet will grow by 3.0% in 2022 and 7.7% in 2023, ending at 27.4 million TEU when we enter 2024.

We must meantime highlight that this estimate does not assume increased demolition because of EEXI and CII introduction on 1 January 2023, nor does it consider the likely implementation of ETS in the EU.

We are, however, quite certain that these regulatory measures will impact average sailing speed and thereby effective capacity supply. On some ships, Engine Power Limitation (EPL) will be used to comply with EEXI, while owners and operators may also wish to cut operational speed to improve CII ratings and limit ETS cost exposure.

EPL may have far-reaching implications on some services where new maximum sailing speed may be lower than current operational speed on some legs, especially head-haul, where sailing speed is generally the highest. EPL will also limit the buffer between scheduled speed and maximum speed, and thereby reduce capability to make up for delays incurred earlier in a port rotation. All in all, some services may have to be rescheduled and ships may need to be added to maintain the existing port rotation. Additionally, transit times on head-haul legs may increase but decrease on back-haul legs in order to maintain sufficient buffer to deal with delays in both directions.

For now, we estimate that the impact on effective capacity supply could be a reduction of 5% in 2023 but must admit that this is only our best guess at this stage.

Congestion has meantime been tying up as much as 10% of fleet capacity during the past 18 months and has equally been a drag on effective capacity supply. A decrease in congestion could therefore increase effective capacity supply without the need for more ships. We believe that congestion will begin to ease towards the end of 2022 when markets will enter a slow season. Naturally, it is too early to say whether sufficient landside capacity and efficiency improvements can be made to reduce congestion to pre-COVID levels, but we will assume that drag on effective capacity supply can be reduced to a maximum of 5%.

Conclusion

The container market is facing significant and unprecedented uncertainties regarding both future demand and supply.

Many indicators point to a slower growth in demand for head-haul and regional trades during 2022 and 2023 than the industry was accustomed to pre-COVID. Conversely, it appears that the fleet will on average grow faster over the two years than in the recent past, and faster than head-haul and regional trade demand.

The introduction of regulatory measures to reduce greenhouse gas emissions adds an additional layer of complexity to forecasts but we believe that effective capacity supply will also grow faster than demand.

It follows that we forecast that the supply/demand balance will weaken, and this should lead to lower freight and charter rates as well as second-hand ship prices. We consider it unlikely that rates and prices will quickly fall towards pre-COVID levels. We cannot, however, fully rule out the possibility if the IMF’s worst-case forecast scenario for the global economy materialises.

SOURCE: BIMCO